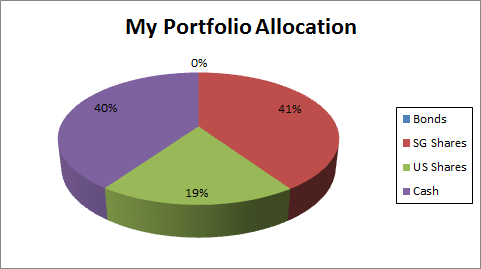

I sold some of my Singapore shares in April and have yet to re-deploy the cash, which was why my cash allocation spiked up to 40%. The overall return in April was +1.8%, which was pretty decent considering my sizable cash position, STI return of +1.7% and S&P500 return of -0.1%. It was boosted by my US portfolio which returned 4.2% because most of the options trade went the right way.

Going forward, I am likely to maintain my Singapore shares allocation or reallocate some of the excess cash into blue chips or O&G sector if there is any significant dip.

See related posts: