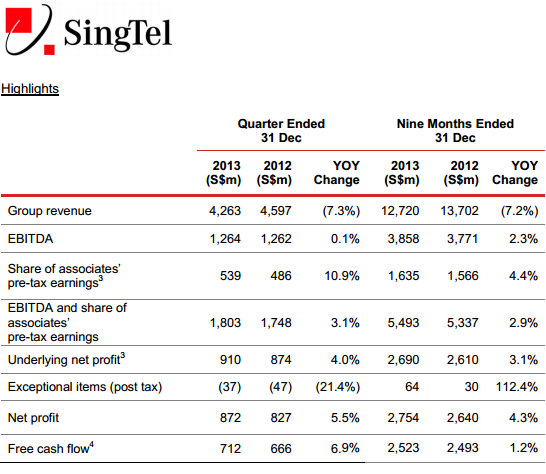

SingTel reported its results for 3QFY14 ended 31 Dec 2013:

- Net profit increases 6% to S$872 million; up 13% in constant currency terms

- Singapore and Australia consumer operations achieve strong EBITDA growth

- Regional mobile associates perform well; deliver earnings and customer growth

- Group mobile customers cross half billion mark

3QFY14 revenue declined 7.3% YoY, mainly due to weaker regional currencies. But net profit rose 5.5%, while core earnings excluding exceptional items climbed 4.1%. The guidance is for low single-digit growth in group revenue and a low double-digit decline in EBITDA.

I hold direct stakes in SingTel and indirectly through STI ETF as well. The valuation is not attractive at 15x PER with flat or low single digit growth. However, given that the company has a steady revenue stream and dishes out regular dividends, I prefer holding onto the stock to keeping the cash under my mattress in the current economic climate.

OCBC Investment Research and CIMB Research have released separate research reports following the results announcement.

Click here for research report by OCBC Investment Research.

Click here for research report by CIMB Research.