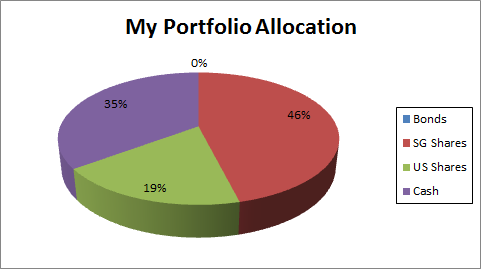

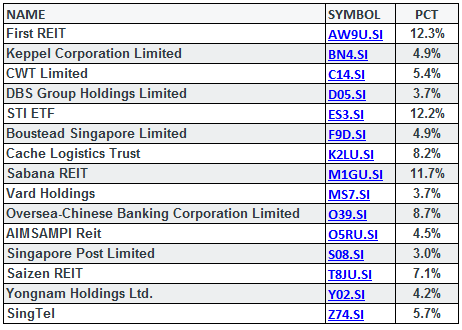

My portfolio allocation and Singapore shares portfolio remained nearly intact in March. The overall return in March was +2.7%, which was pretty decent considering the 35% allocation in cash. I am pleased with some of the paper gains in CWT Limited, Vard Holdings and OCBC. I have also injected fresh funds amounting to 2.7% of the total portfolio to contribute to a healthy growth of 5.4% in my investment portfolio just for the month of March.

Even though my US trading portfolio outperformed S&P500, I am quite concerned about the volatility in the US market recently. Going forward, I am likely to trim my Singapore shares allocation slightly in view that the best six months are nearly over. I will also review and re-balance the long-short ratio for my US trading portfolio during the upcoming earning season in April.

See related posts:

can you share with your US portfolio? i intent to invest in US, but quite new and no idea how to start? appreciate it if could like to share. thanks

Hi Eugene,

If you are new to investing in US markets, I suggest you try out either local brokerages such as Kim Eng or Phillip, or US brokerages with local offices such as E*TRADE or thinkorswim, depending on your comfort level.

My US portfolio consists mainly short-term trades in put and call options which is not recommended for beginners because of leverage and margin trading. I recommend sticking to normal shares or ETF first. If there is sufficient interest, maybe I will blog more about trading in US markets in future.

Glad that you diversified your investments across asset classes.

Perhaps you may want to consider buying bullion now.

Regards,

SG Wealth Builder

http://www.sgwealthbuilder.com

Hi Gerald,

Thanks for the suggestion. I feel that the outlook for bullion is very uncertain. Appreciate if you share your thoughts on this. Thank you.